National Australia Bank

Security Management

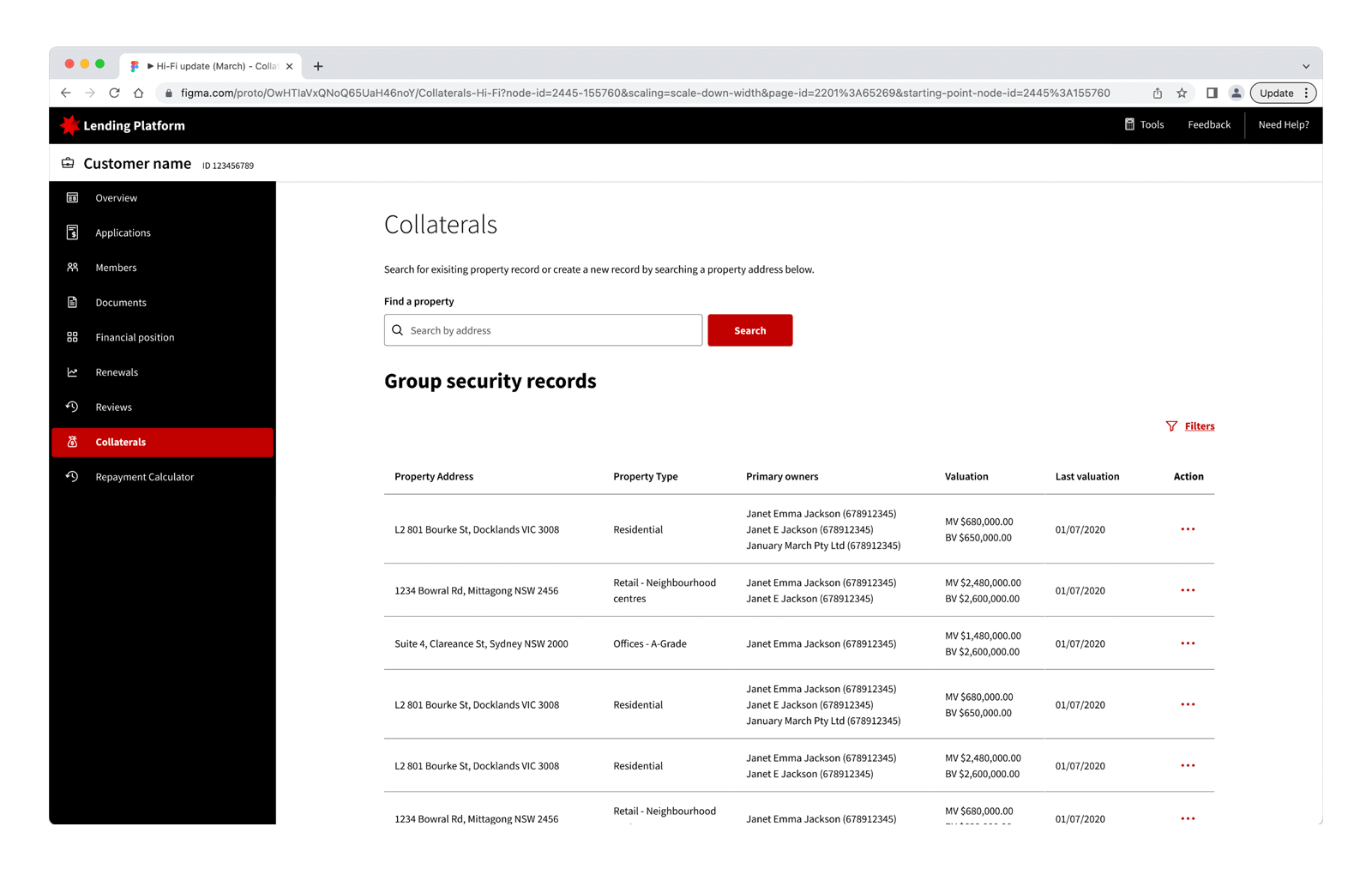

Enhancing and improving the management of securities and collateral for business lending.

CX Research & Design

CX Research & Design

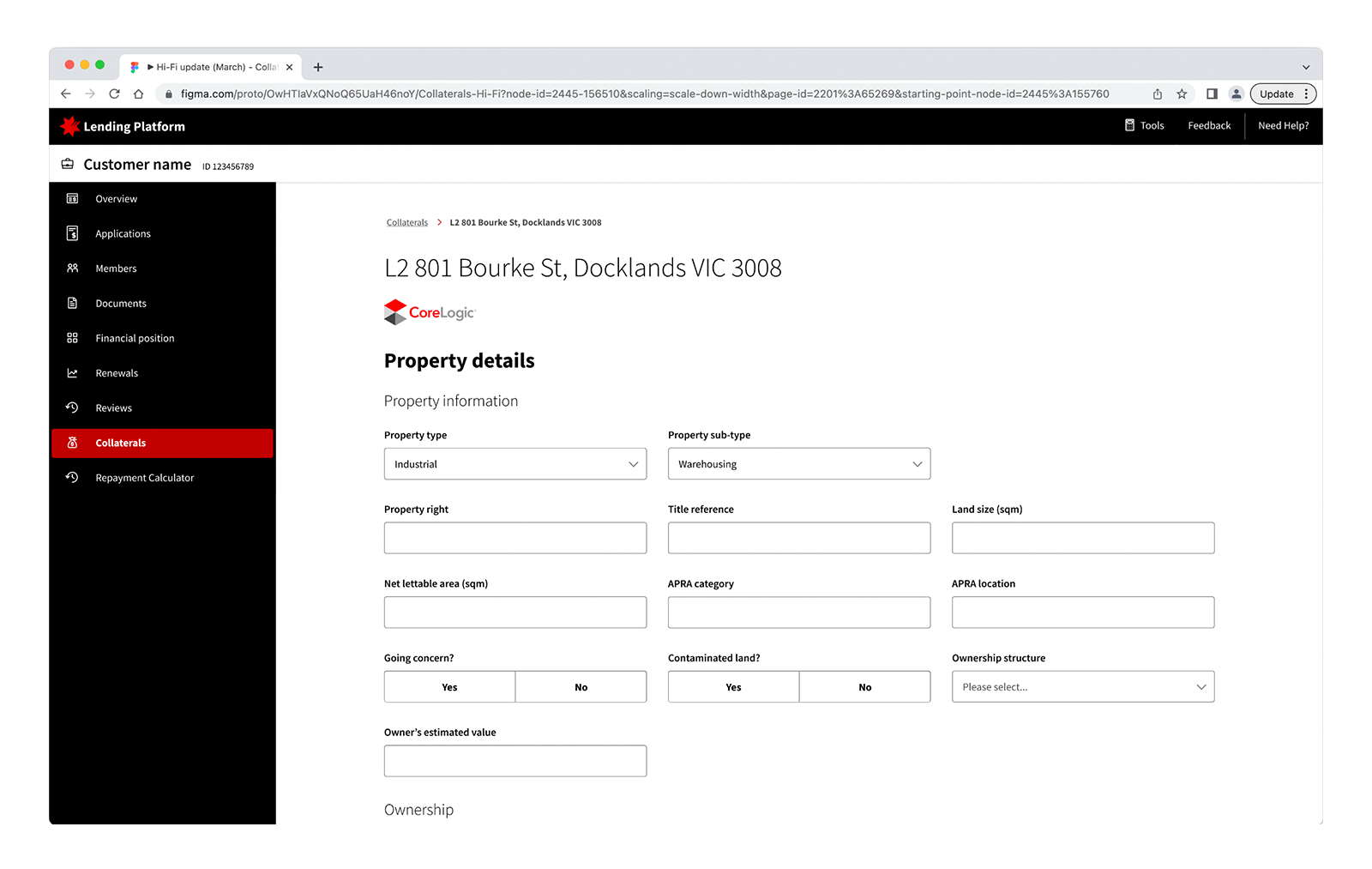

Legacy solutions for security and collateral management are inaccessible, unscalable, and lack data integrity, resulting in inaccurate outcomes and rework, particularly for less experienced bankers.

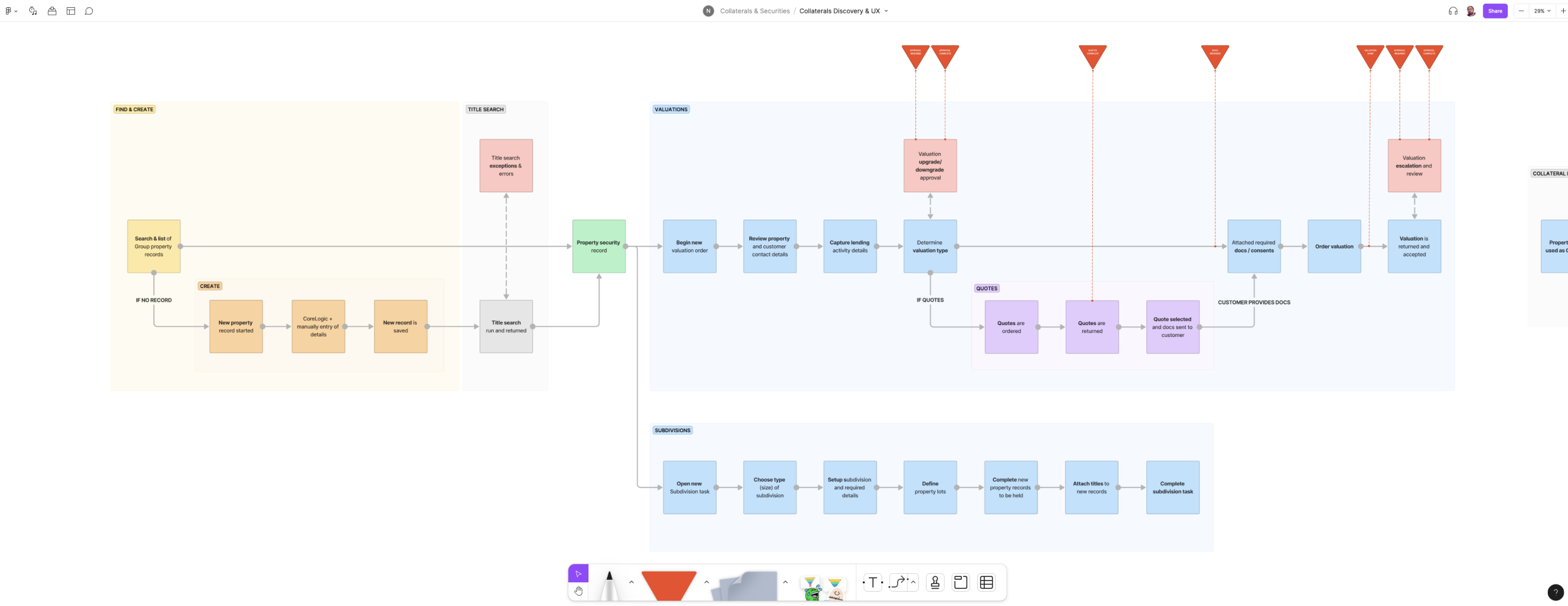

Service & System Mapping

The project originated from strategic business needs for an enterprise-level securities database. However, it also brought significant benefits to bankers in their daily roles. To support this, we sought to understand our bankers' varied roles and workflows related to security management.

We interviewed bankers from different cohorts, gathering valuable insights into their workflows, existing problems, pain points, and opportunities. These findings helped us identify and prioritize potential solutions.

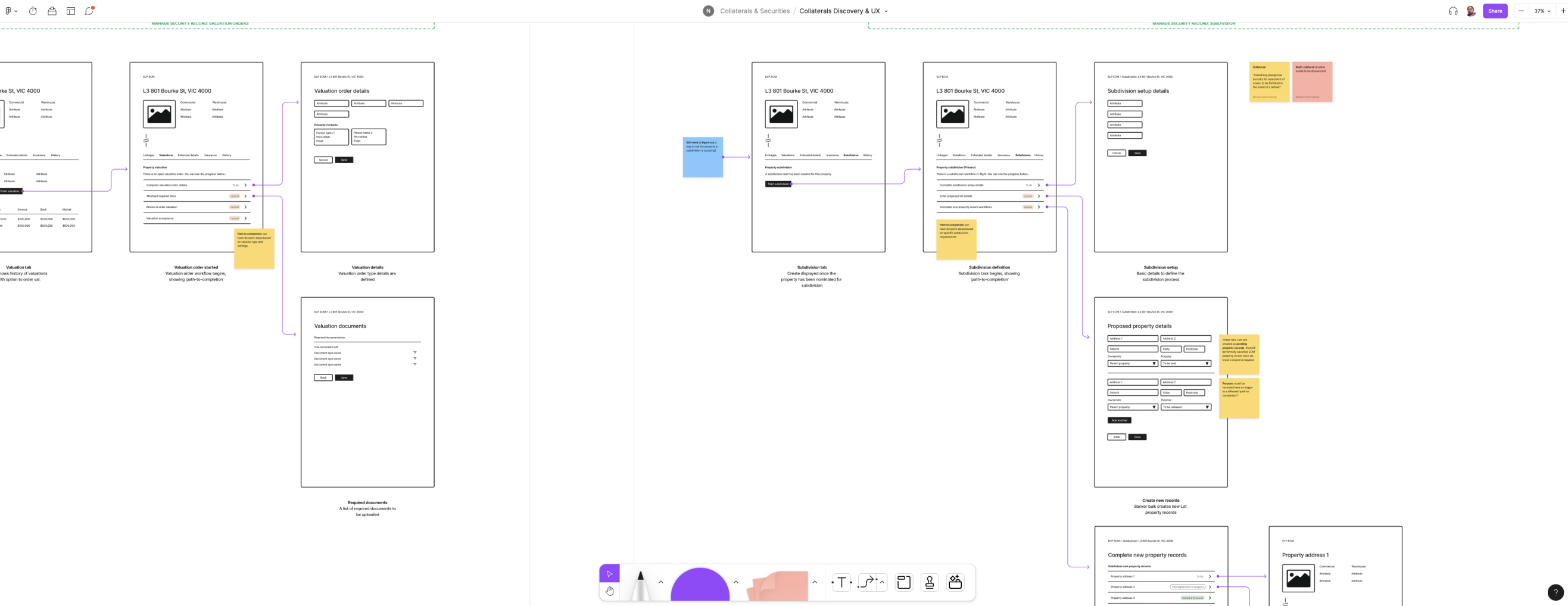

With limited time and budget, we quickly moved into low-fidelity prototyping to gather user feedback and additional insights.

Service & System Mapping

Banker Interviews

Prototype Testing

Low-Fidelity Customer Experience Design

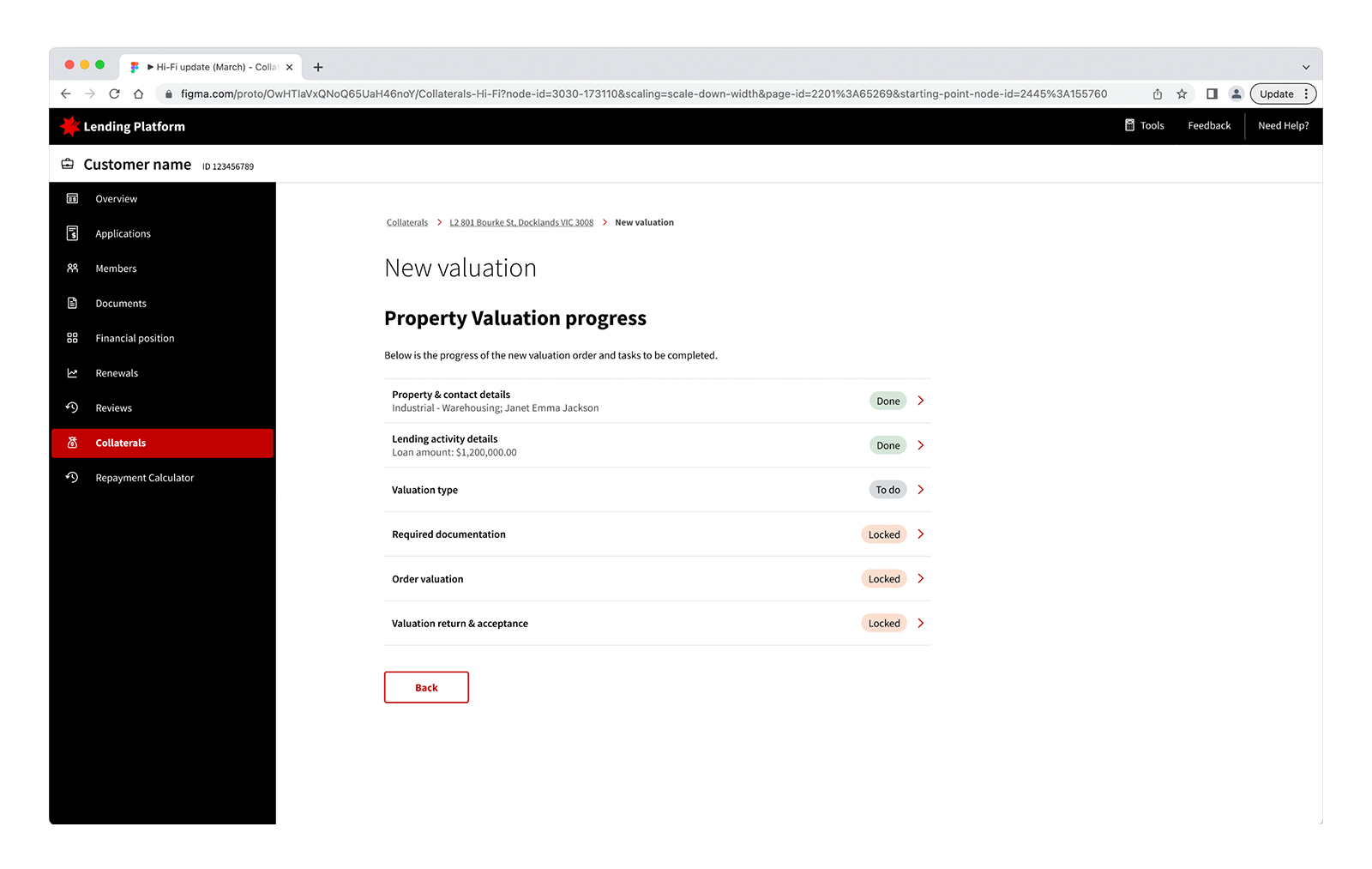

Defining an MVP that balanced the needs of bankers with business goals required tough decisions. Some capabilities were backlogged for future releases, particularly those balancing automation and manual work for bankers.

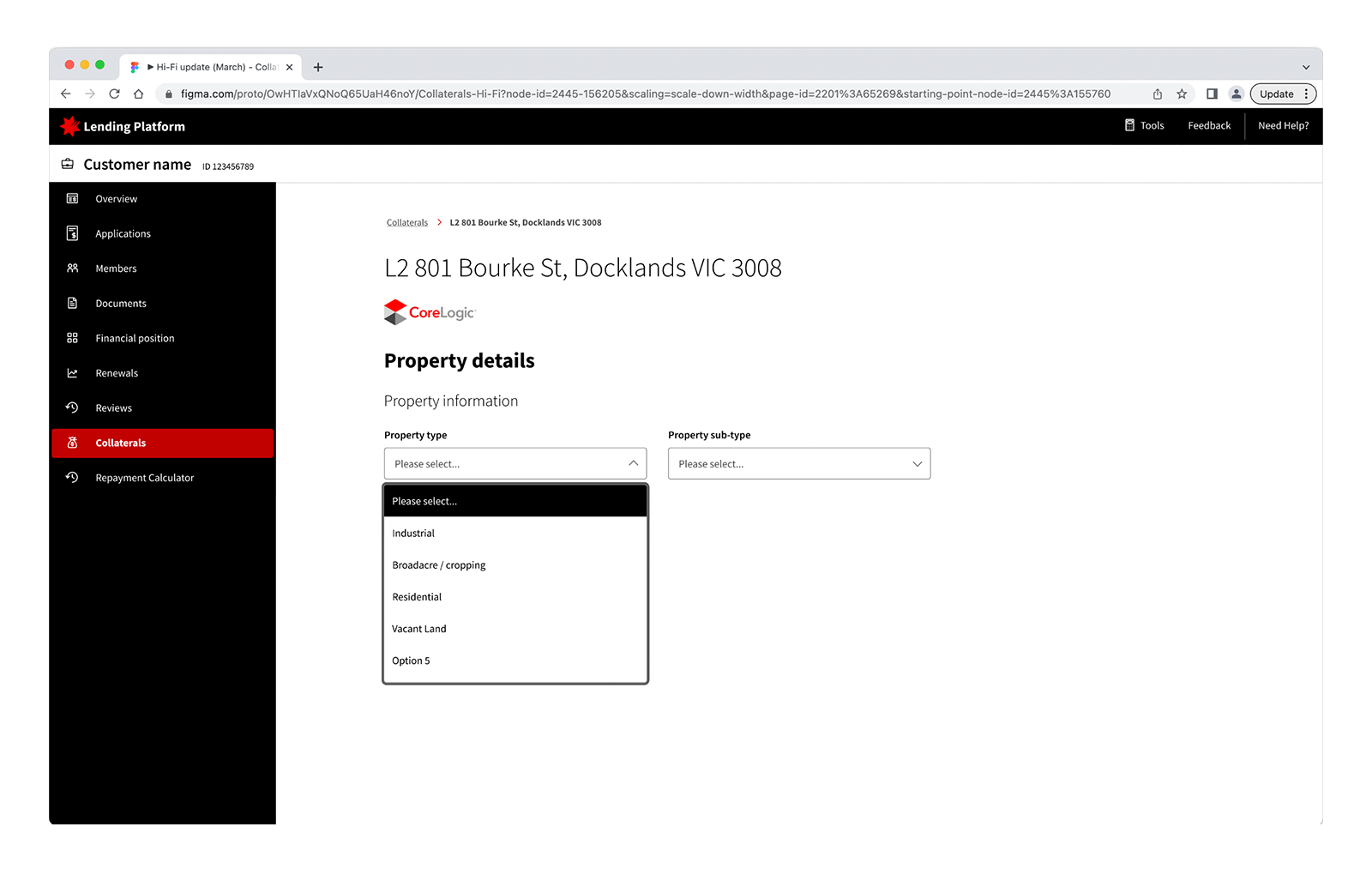

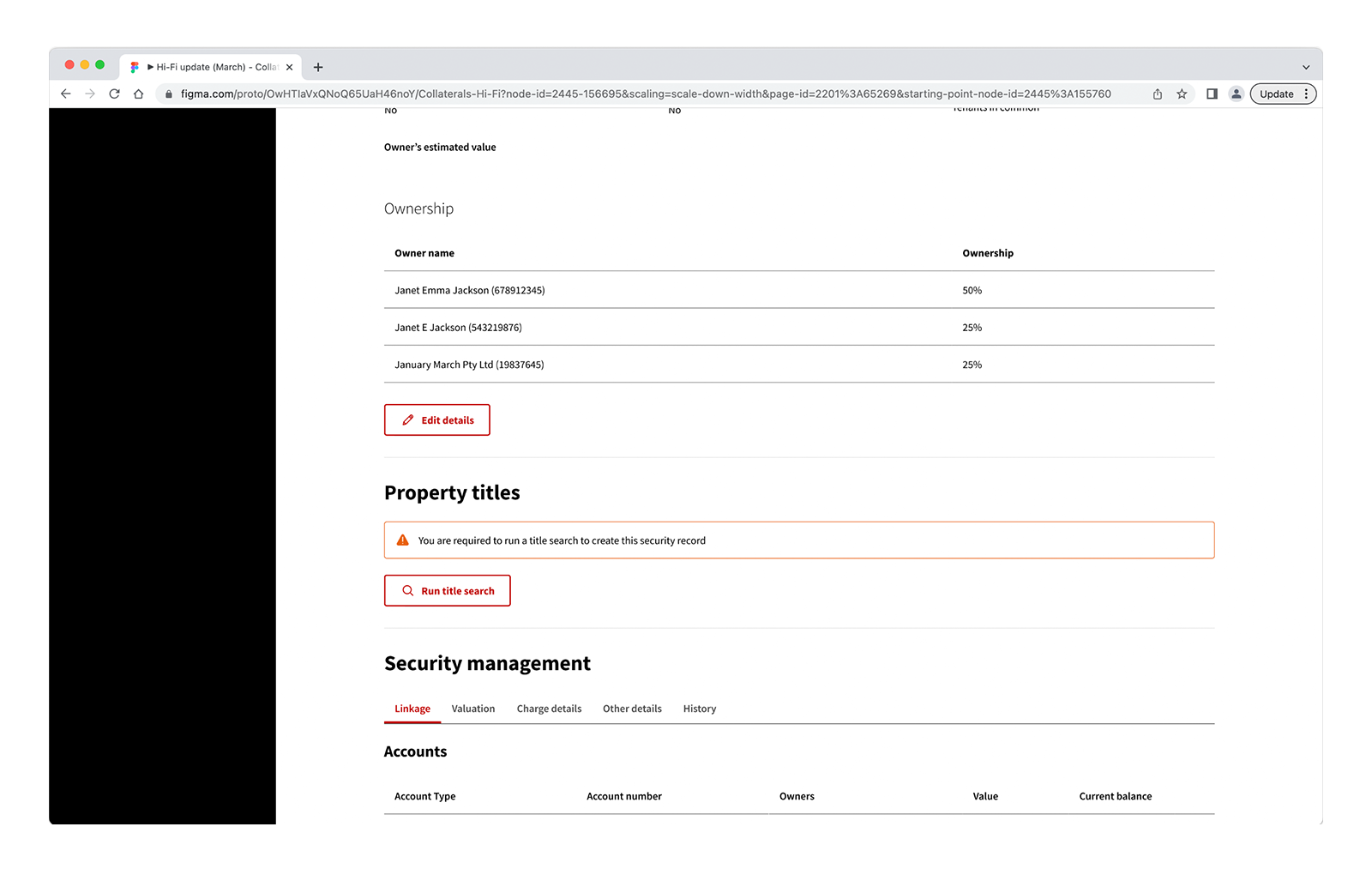

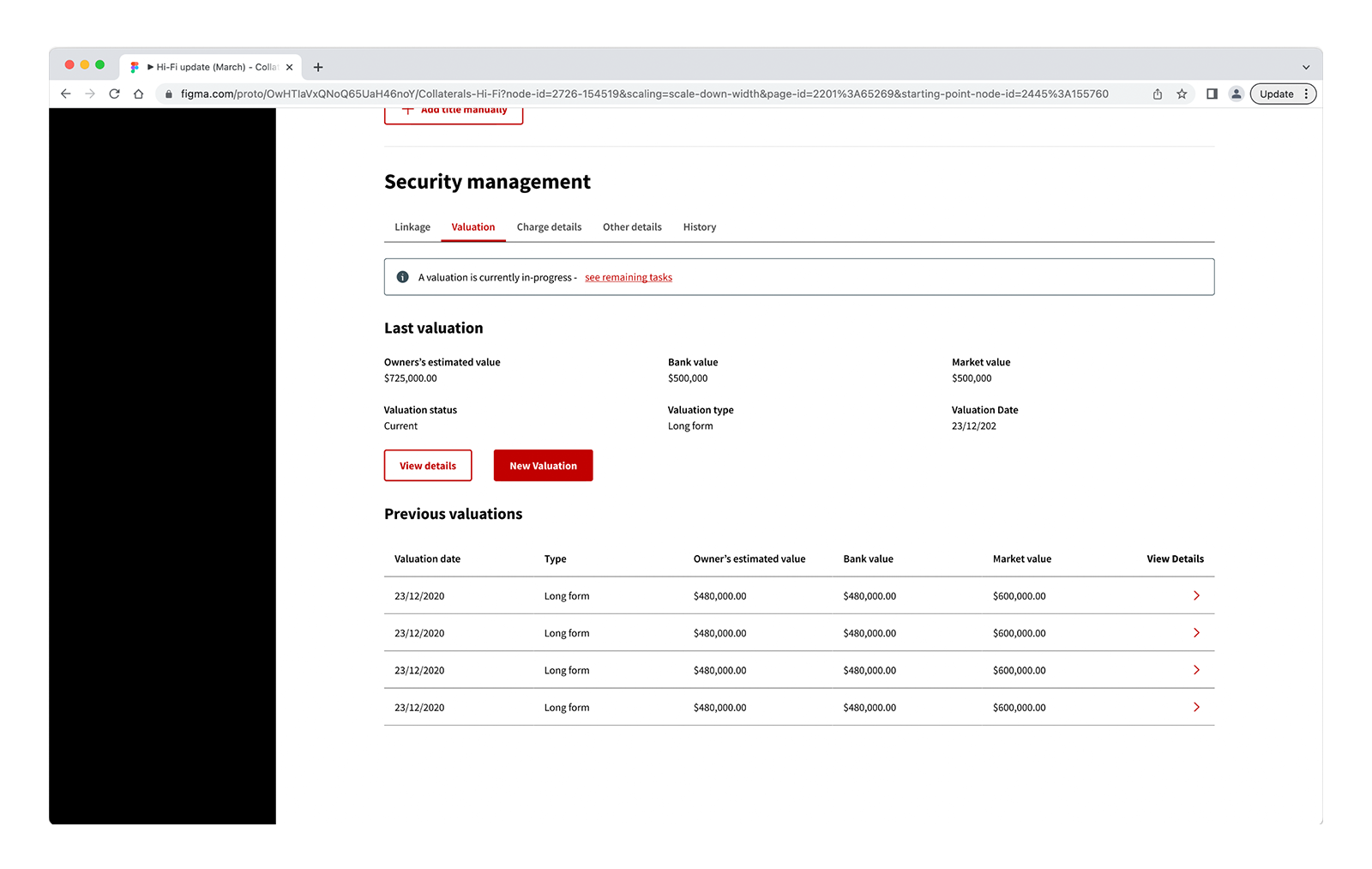

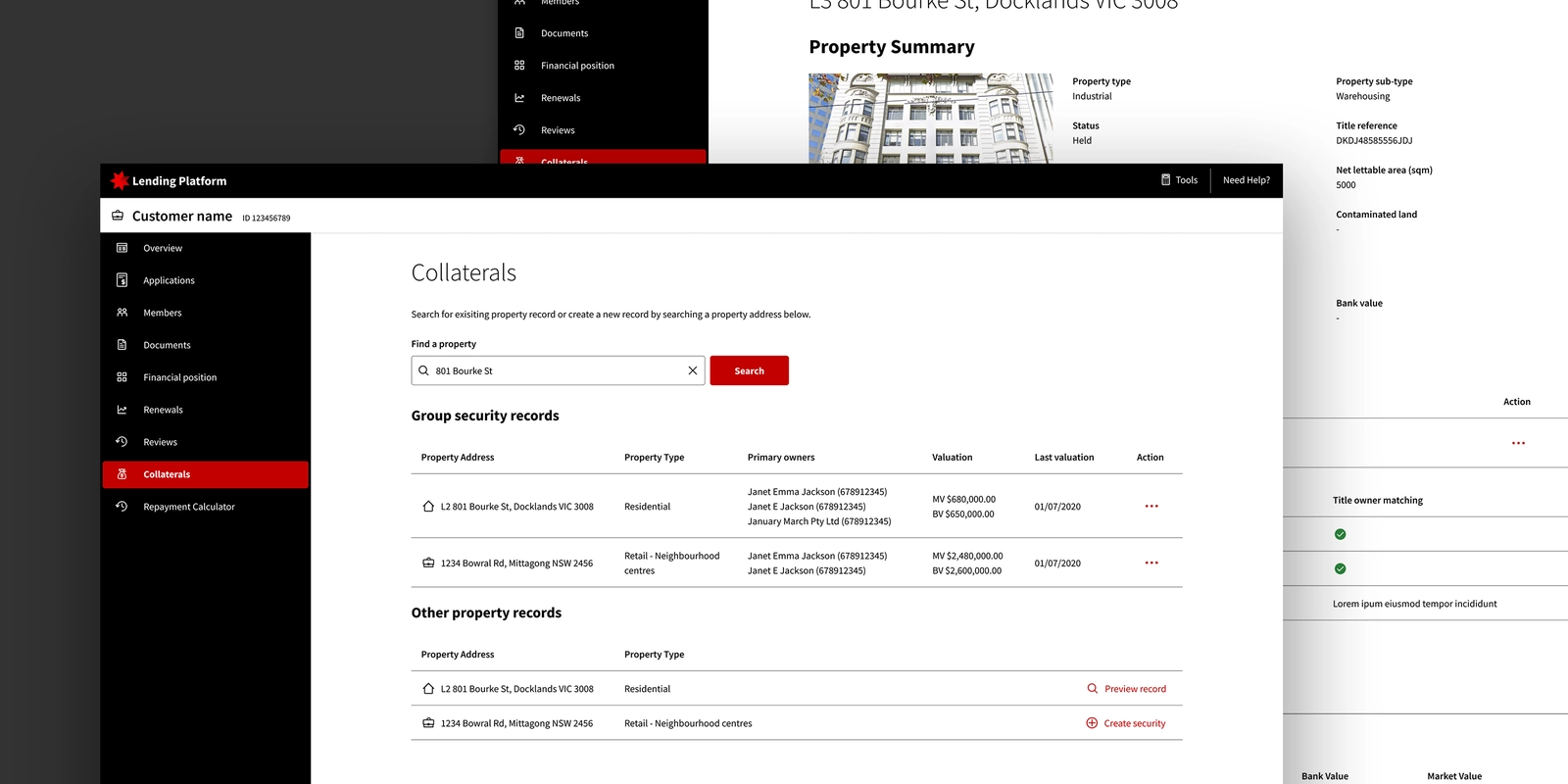

Creating Data Relationships

The most complex challenge was simplifying relationships between lending activities, securities, and customers. While this might sound straightforward, corporate and commercial scenarios introduced significant complexities.

Multiple Actor Interactions

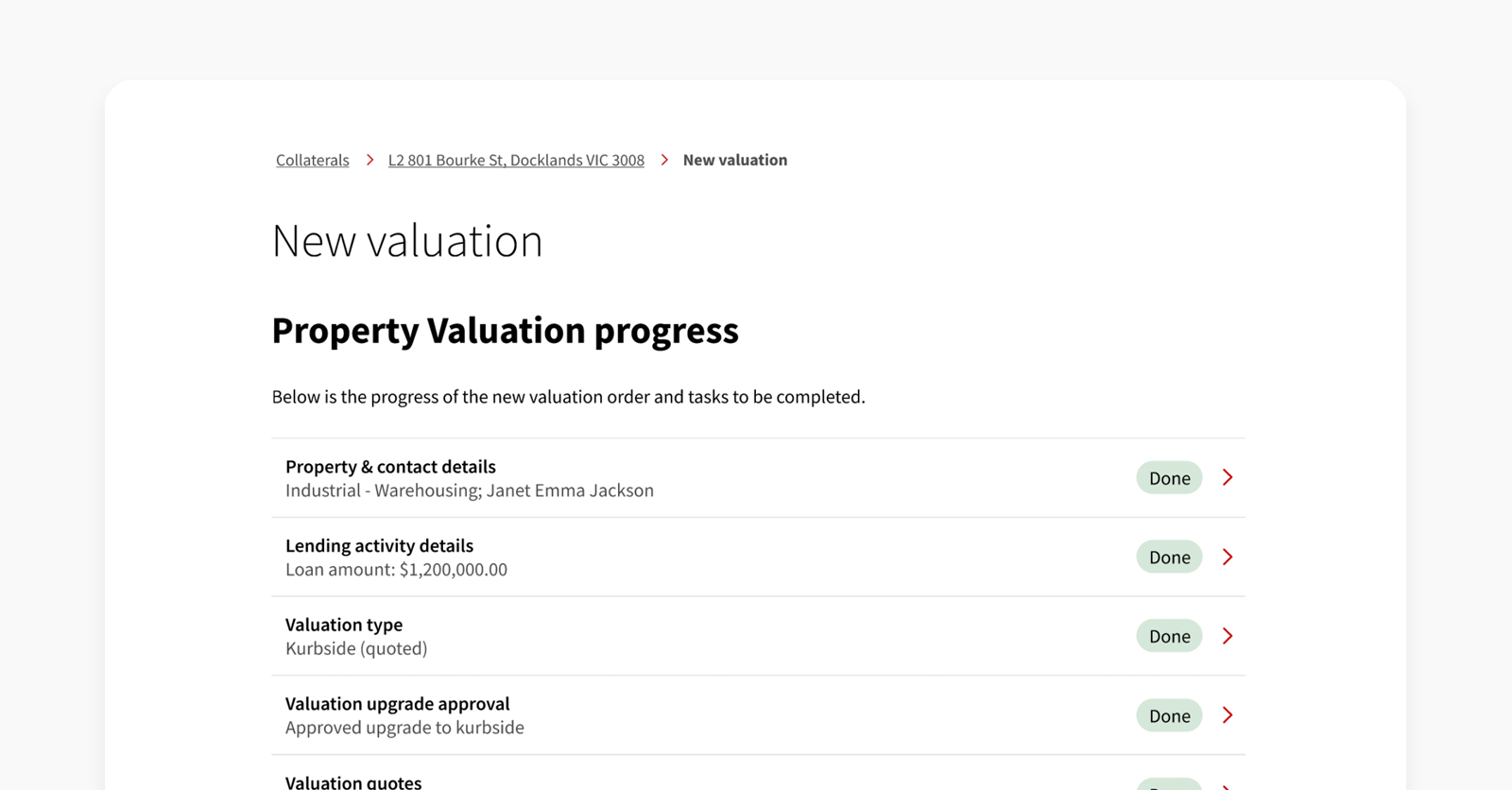

The lending journey involves various bankers, from frontline staff to associates, credit decision-makers, and fulfillment teams. While we aimed to automate many interactions, constraints required us to prioritize the most critical ones.

The initial pilot release was successful. Bankers appreciated the integration of the database into their existing workflows, eliminating the need to pivot between systems.

Manual data entry between systems was minimized, and new and inexperienced bankers benefited from improved guidance and support throughout the process.