Westpac Group, Business Bank

Merchant Origination

Building an enterprise merchant management solution to replace six legacy systems

UX & UI Design

UX & UI Design

Bankers are required to use up to six different systems to onboard and service new and existing merchant customers. This involves excessive manual data entry, duplication, and non-compliant workarounds, which slow down credit decisions and fulfillment procedures.

HCD team design review session

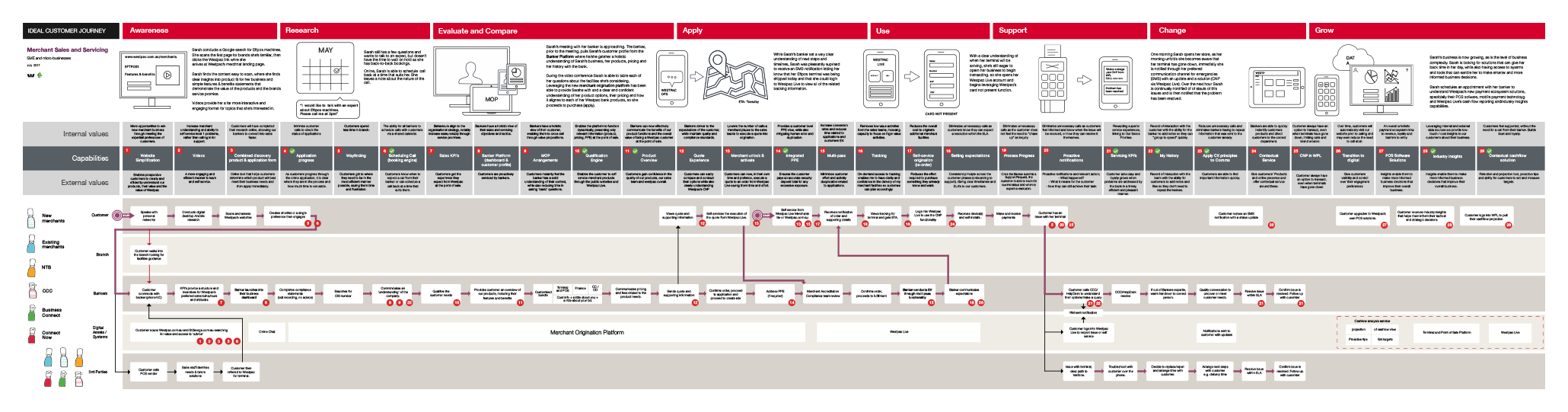

Working within a large, multi-functional team, we kicked off our discovery phase with a thorough review of the as-is procedures and processes to fully understand existing pain points and capability gaps. This allowed us to identify opportunities to better serve our customers and support our bankers.

We achieved this through discussions and interviews with internal subject matter experts, small business owners, frontline bankers, and fulfillment staff, covering all those involved in merchant servicing and terminal fulfillment.

Customer & Banker Journey Mapping

Banker Interviews

Prototype Testing

Merchant Sales & Servicing Blueprint

While there were many technical obstacles involving hundreds of API calls, information architecture proved the largest concern. The complexity of tasks, workflows, and compliance measures made tackling this a challenge, especially while catering to both banker and customer journeys.

System Complexity

Although part of the project's focus was system simplification, it became a larger issue as we mapped out the banker journey and uncovered new complexities. We needed to reevaluate and focus on the end-to-end service rather than just the digital platform to provide better outcomes for customers.

Business vs. Customer Outcomes

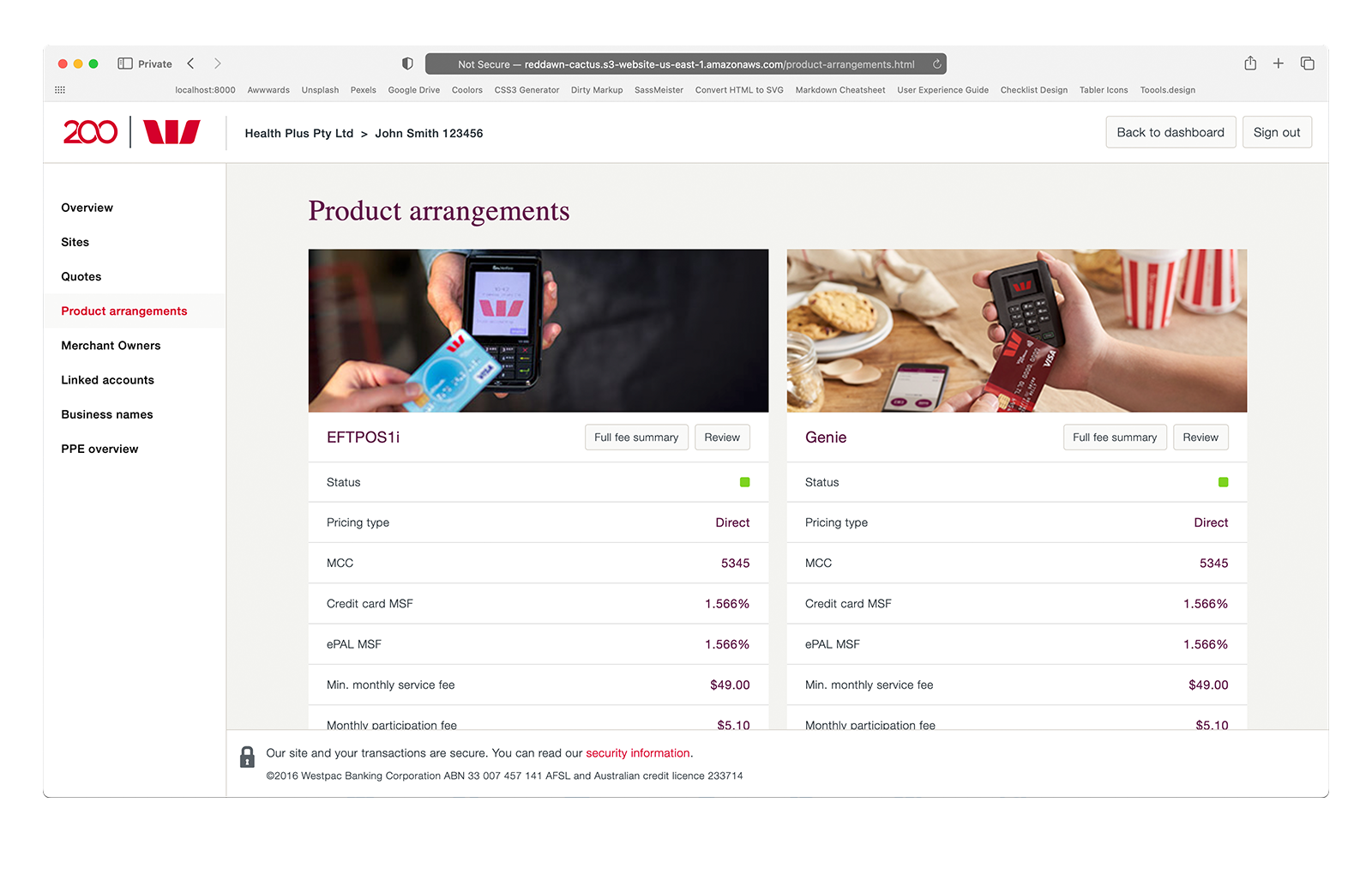

While the project was focused on bankers' needs, customers ultimately bore the outcomes. This customer-centric focus revealed insights into pricing models, true product needs, and misunderstandings about costs and add-on services.

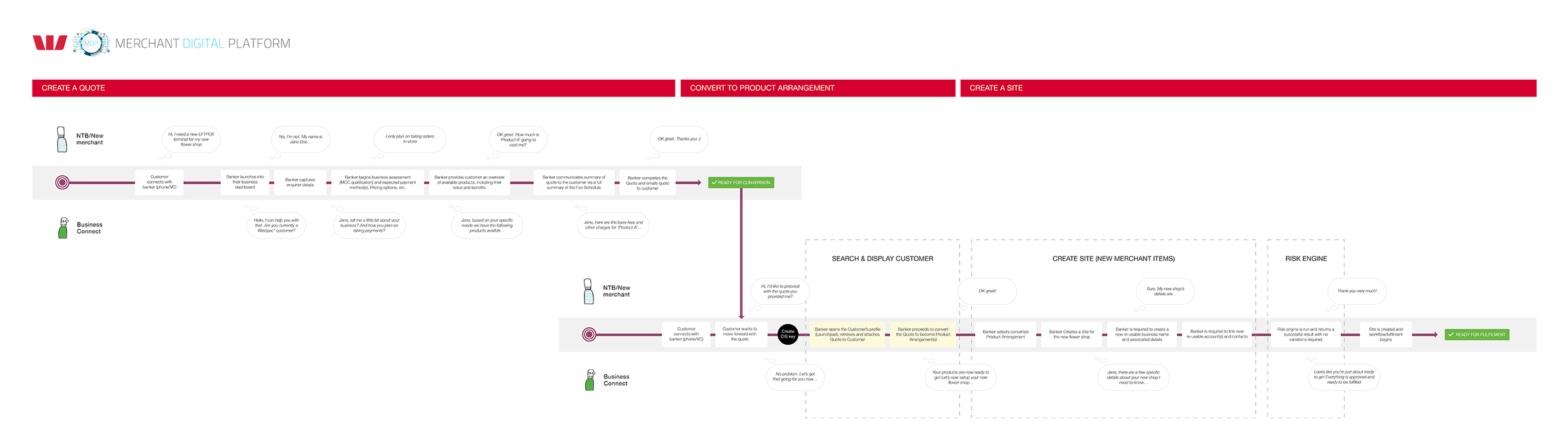

Customer Conversation Map

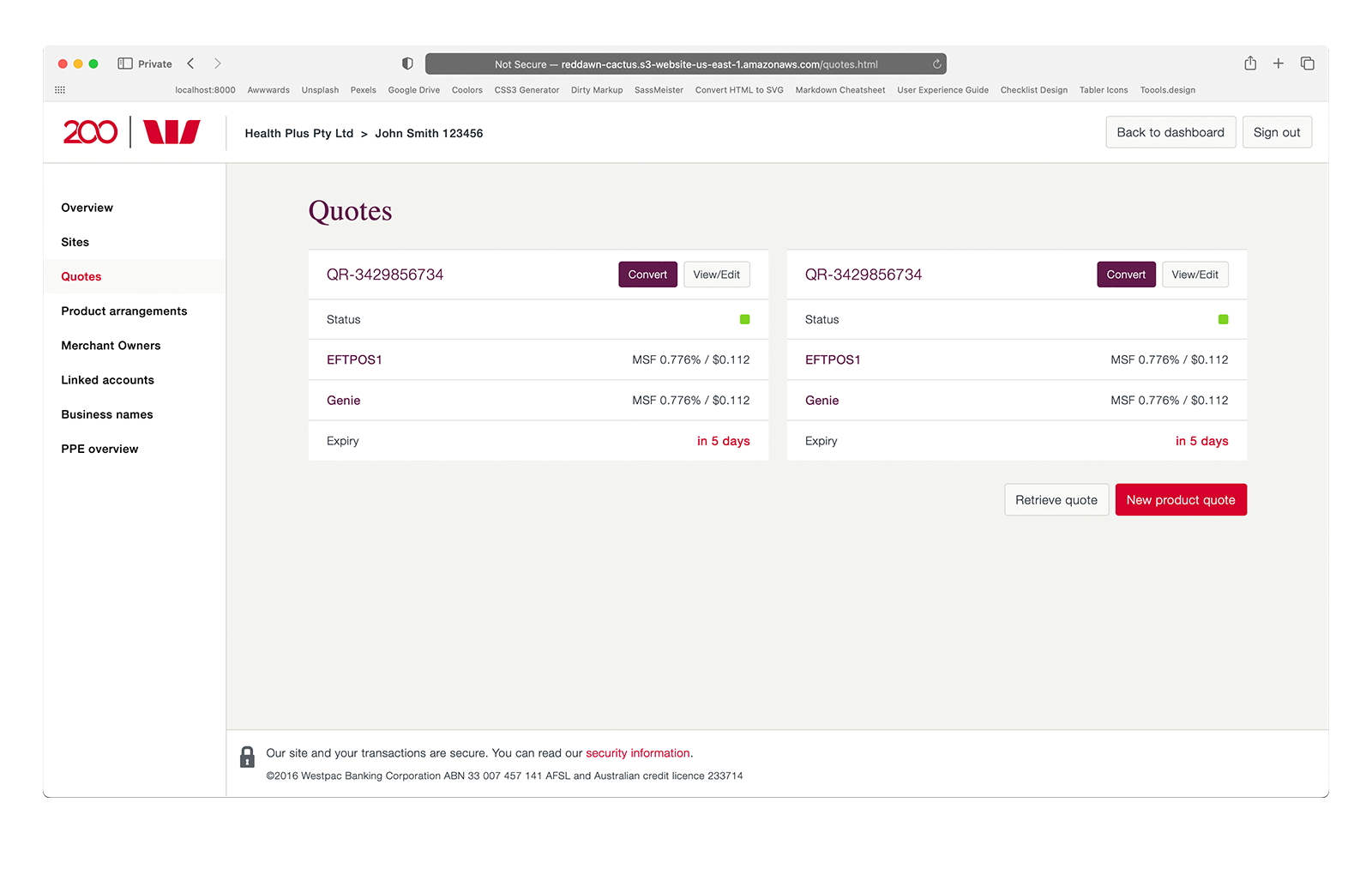

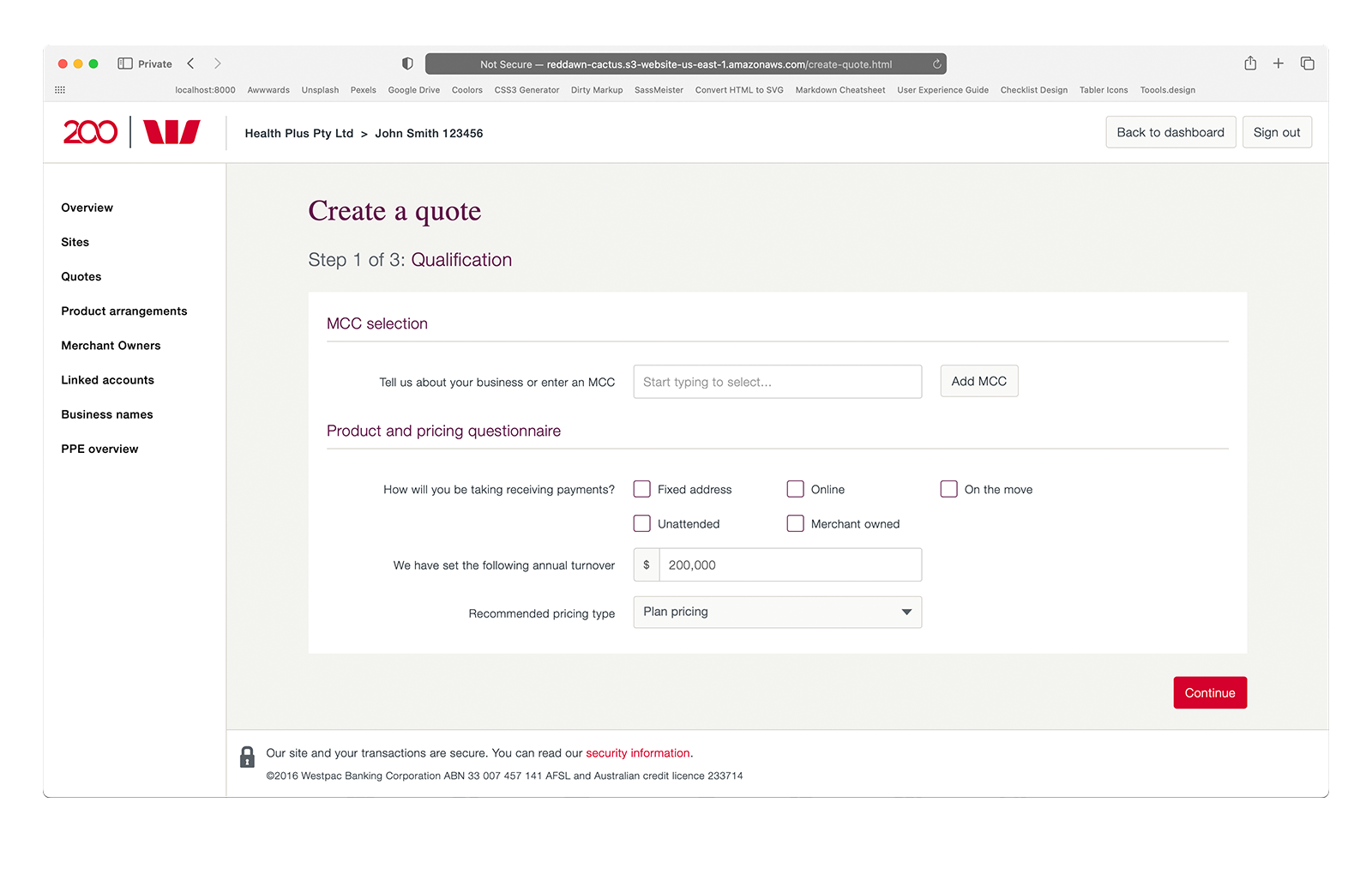

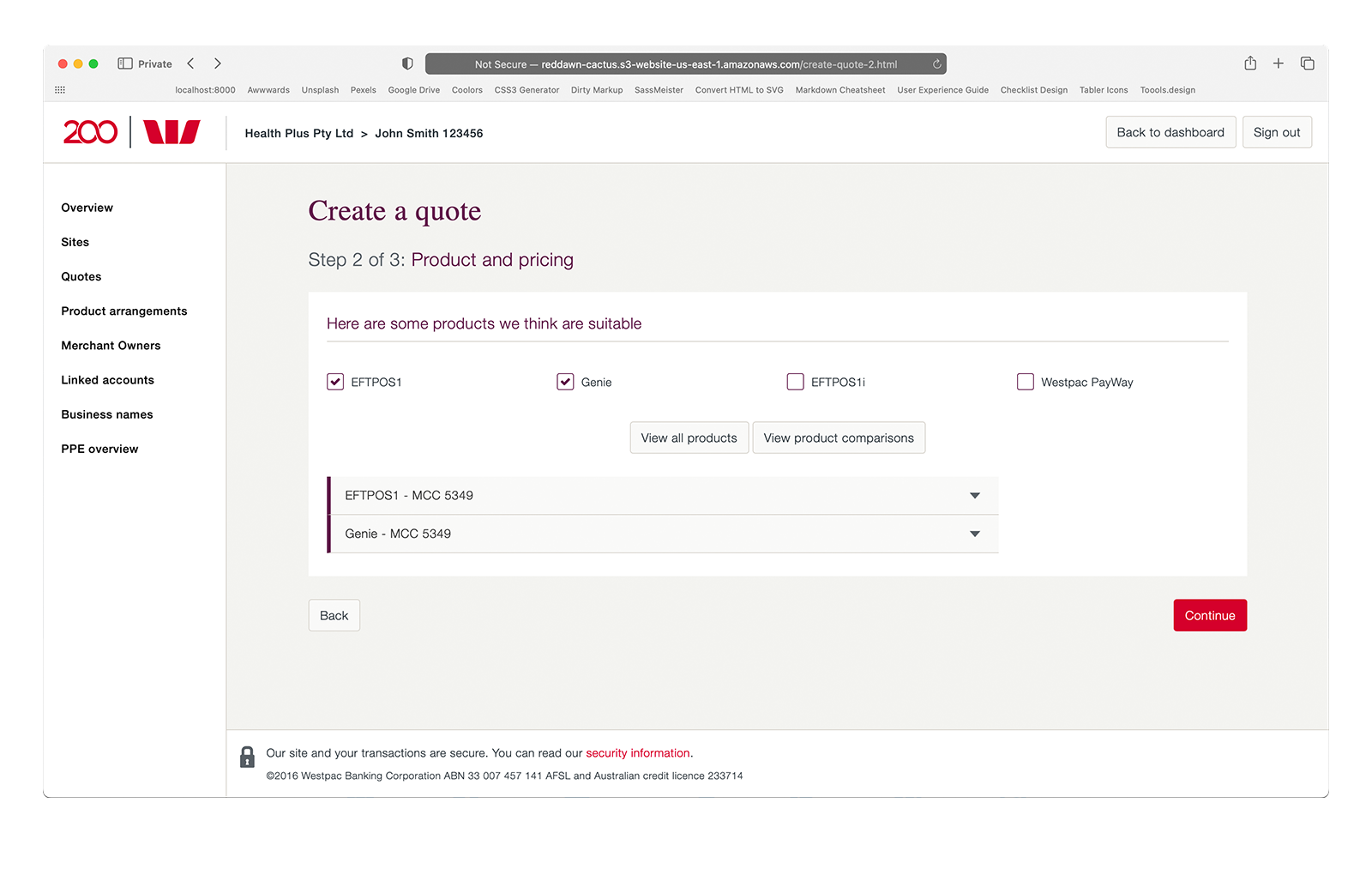

The Minimum Viable Product (MVP) was released with a roadmap for enhancing existing features and introducing new ones. The main wins achieved by the platform's rollout included:

Workflow Simplification

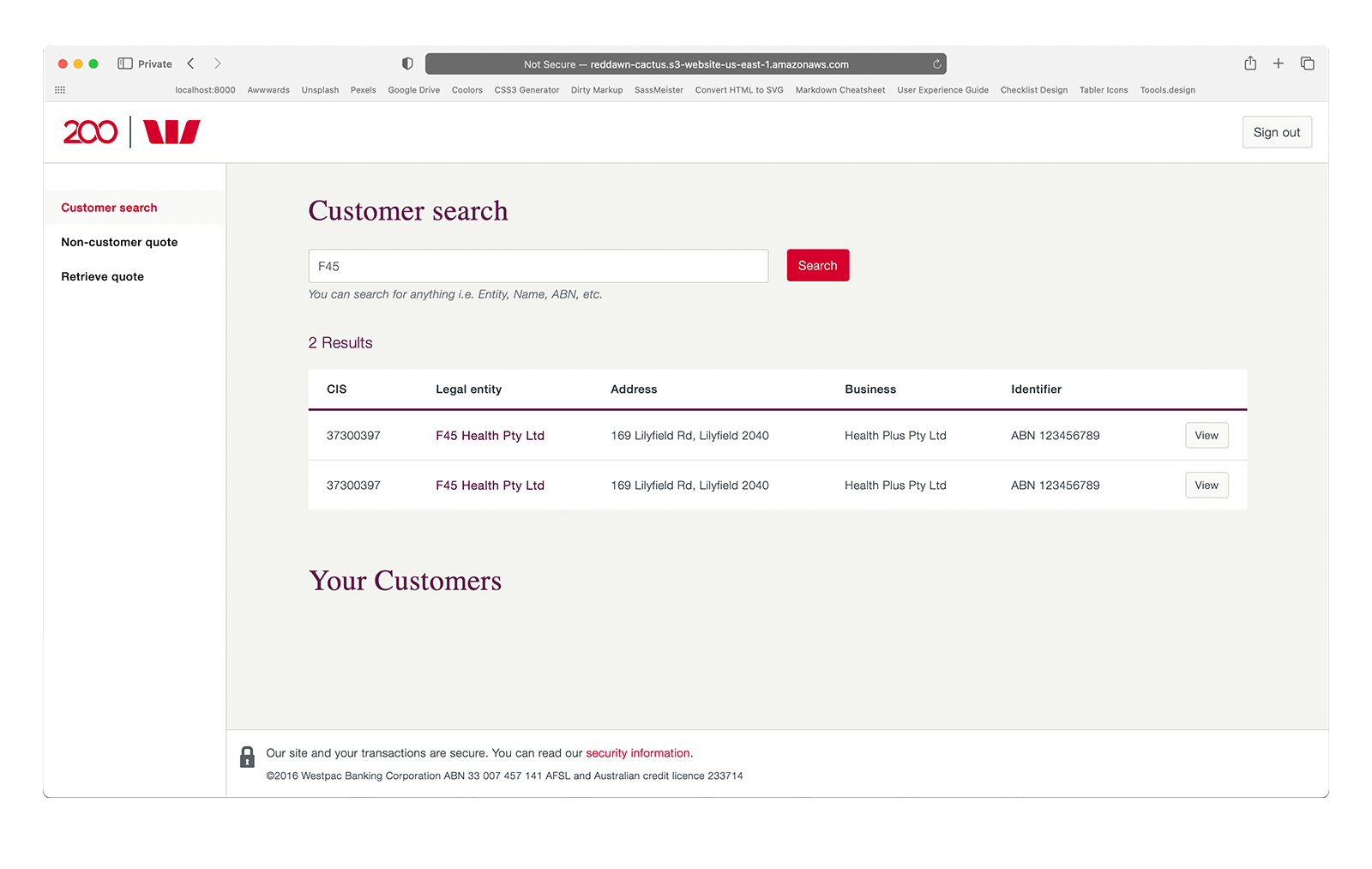

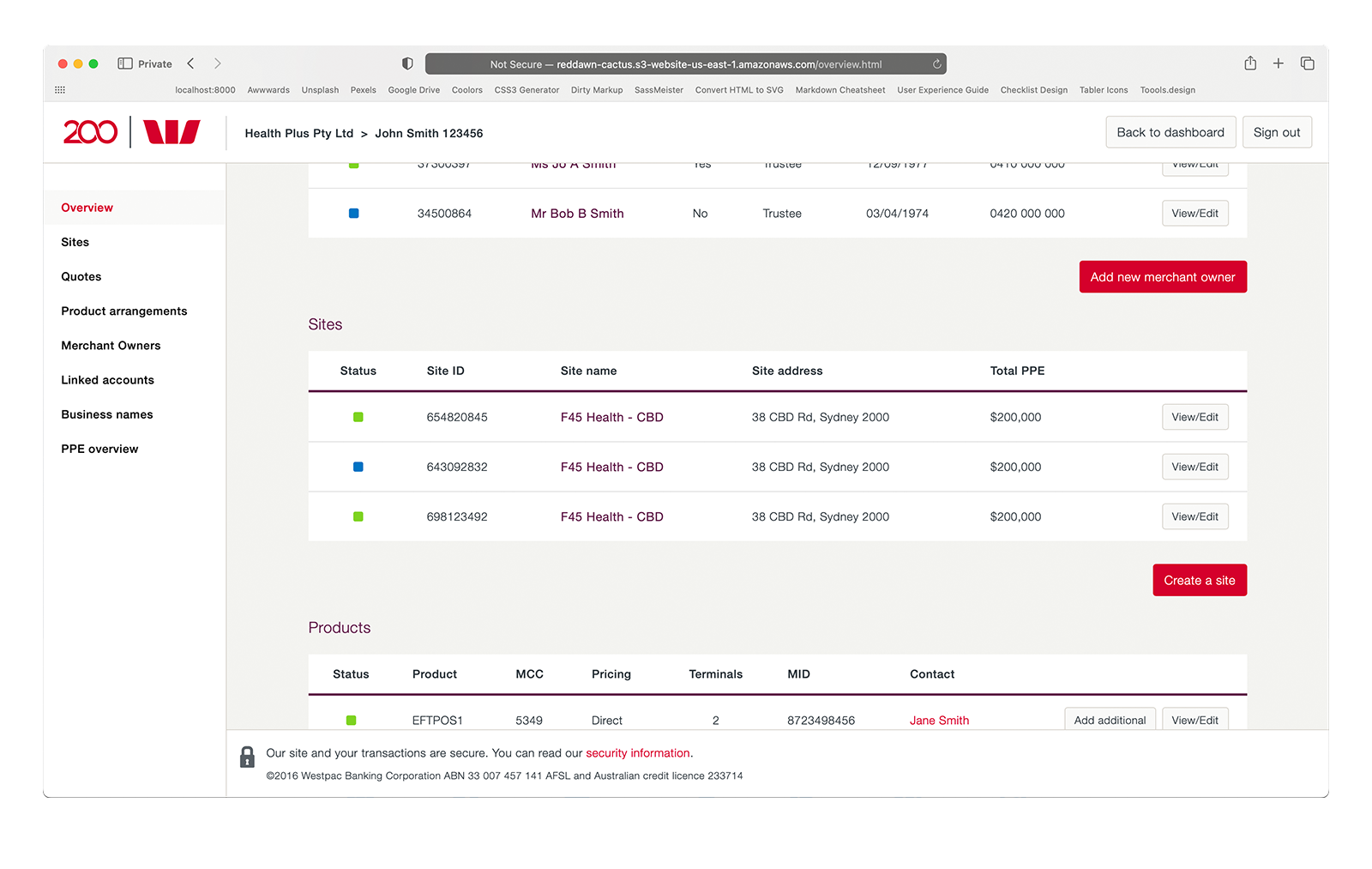

Bankers previously had to 'swivel-chair' between six different systems to onboard new merchant customers. This has been consolidated into a single point for origination and servicing requests.

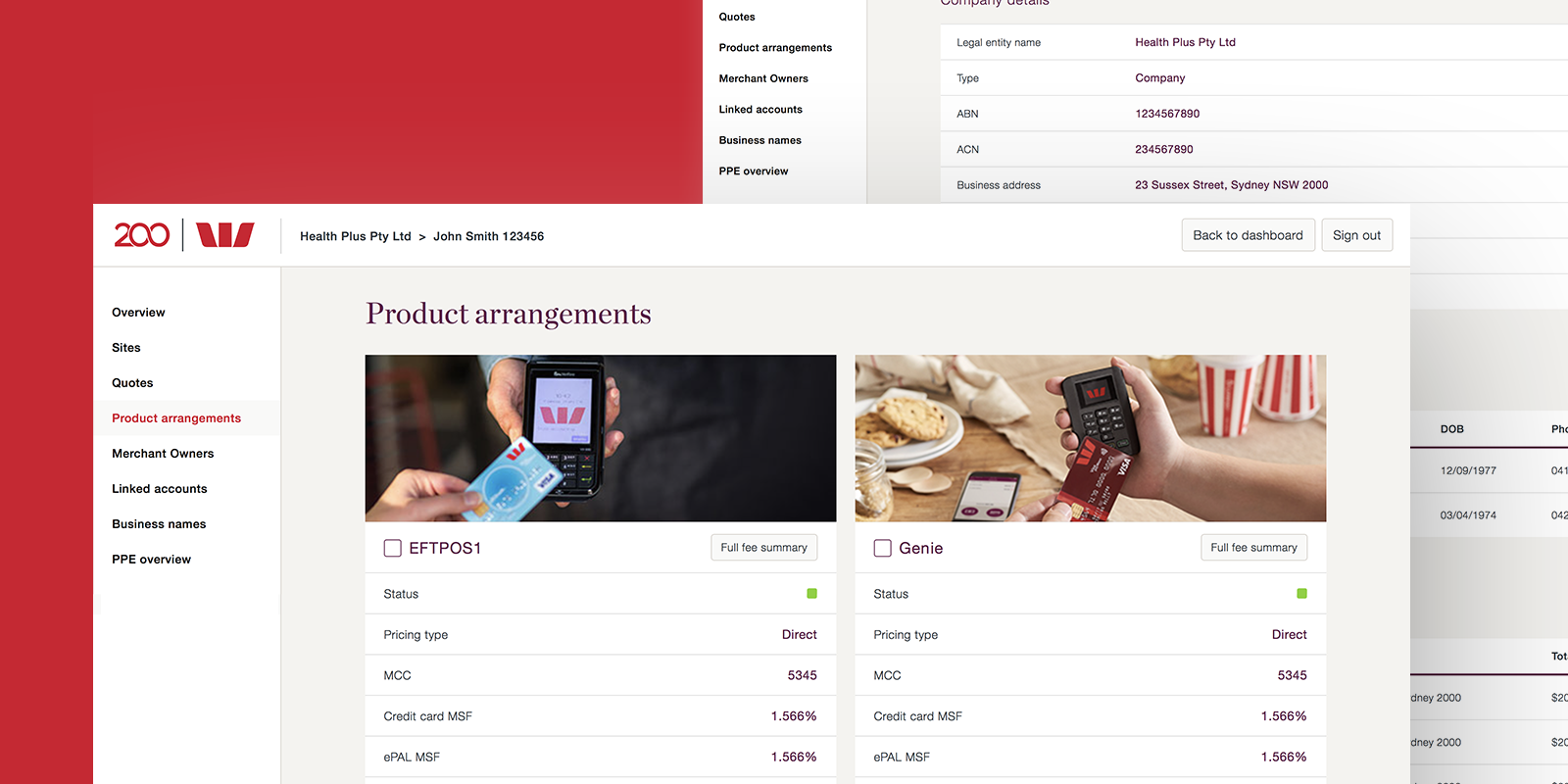

Better Customer Insights

Enhanced customer records and data synthesis provide bankers with a more holistic view of customers, enabling them to recommend products tailored to specific business needs.

Faster Decisions

Customers who previously waited up to two weeks for a decision on their request, which involved manual risk and pricing approvals, now experience a digitized process with time-to-approval reduced to just two days.

Future Self-Service

Workflow improvements through a single origination point allow for the development of a customer-facing portal, enabling self-service origination and servicing.